PGI

Exploring Wealth Building With Napoleon Hill’s Investment Principles

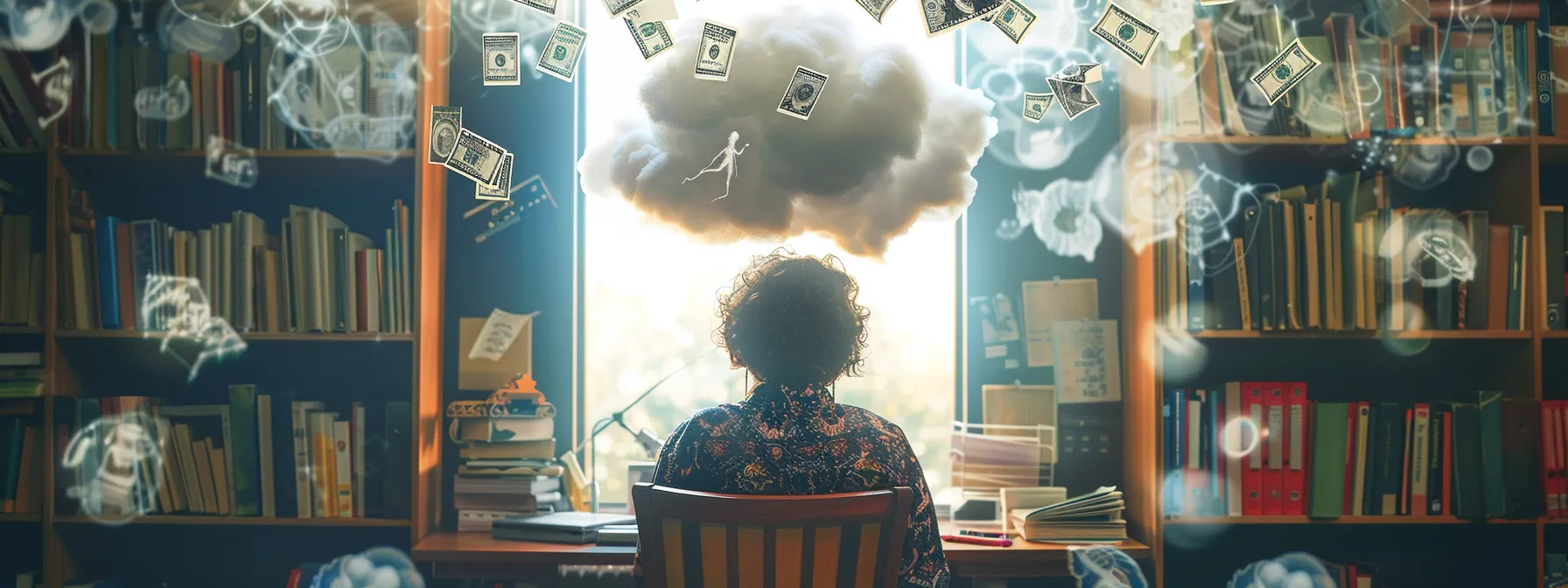

Are you struggling to build your wealth despite your best efforts? Many people face challenges in achieving financial success, often feeling stuck or overwhelmed. In this article, we will explore Napoleon Hill’s investment principles, focusing on key concepts such as definiteness of purpose, the importance of specialized knowledge, and how to overcome failure through persistence. By understanding these principles and applying them to your financial journey, you can transform your desire for wealth into tangible results and create a roadmap to success.

Introduction to Napoleon Hill‘s Wealth Principles

Napoleon Hill‘s legacy in wealth building emphasizes the importance of mentorship, imagination, and intuition. His investment philosophy encourages readers to harness the power of the mind to achieve financial success. Understanding Hill’s principles is increasingly relevant in today’s economy, where innovative thinking and personal growth play critical roles in wealth creation.

The Legacy of Napoleon Hill in Wealth Building

Napoleon Hill‘s legacy in wealth building centers on the transformative power of mindset. He believed that cultivating a positive mental attitude is essential for achieving success. By fostering belief in your abilities and maintaining a focus on your goals, you can harness the power of your thoughts to shape your financial future.

Hill emphasized the significance of knowledge and its role in decision-making. He argued that continuous learning is crucial for personal and financial growth. By seeking knowledge and applying it effectively, you position yourself to make informed choices that can lead to wealth accumulation.

Another key aspect of Hill’s philosophy is the concept of autosuggestion. This idea revolves around the practice of constantly reinforcing positive beliefs through affirmations. By consistently engaging in this practice, you can train your subconscious mind to embrace success, ultimately driving you toward your financial aspirations. Consider these essential principles:

- Adopting a positive mental attitude.

- Continuous pursuit of knowledge.

- Implementing autosuggestion for success.

Overview of His Investment Philosophy

Napoleon Hill’s investment philosophy, encapsulated in his seminal work “Think and Grow Rich,” emphasizes the significant role that mindset plays in wealth accumulation. He argues that personal development is pivotal; a strong belief in your ability to succeed can lead you to greater financial achievements. By addressing and overcoming fear, you open yourself up to opportunities that might otherwise be missed.

Hill’s teachings encourage you to embrace the principles advocated by his mentor, Andrew Carnegie. The focus lies on developing a clear vision of what you want to achieve and aligning your actions towards that goal. This philosophy of continuous goal-setting and relentless pursuit empowers individuals to take charge of their financial future with confidence.

Another fundamental aspect of Hill’s investment philosophy revolves around the concept of persistence. He believed that consistent effort, paired with a well-defined plan, is essential to overcoming obstacles. When you combine this determination with knowledge and the right mindset, you create a foundation for ongoing personal and financial growth. Key takeaways from Hill’s principles include:

- Emphasizing a strong belief in your financial goals.

- Learning from influential figures like Andrew Carnegie.

- Practicing persistence in the face of challenges.

Relevance of Hill’s Principles in Today’s Economy

Understanding Napoleon Hill‘s principles is vital in today’s economy, where intelligence and creative thinking are essential for navigating financial challenges. The emphasis on developing one’s subconscious through positive thinking and persistence can be transformative as you strive to create wealth. When you align your thoughts with your financial goals, you shape your reality and open doors to opportunities that may not have been apparent before.

Hill’s concept of “the sixth sense” is particularly relevant today, as it encourages you to trust your intuition when making investment decisions. In a fast-paced and unpredictable market, the ability to tap into your inner guidance can provide a significant advantage. By fostering creativity alongside analytical skills, you can identify unique investment opportunities and develop innovative strategies that set you apart from the competition.

Furthermore, Hill’s teachings on continuous personal development and learning resonate strongly in our current environment. As new markets emerge and existing ones evolve, embracing a mindset of growth can empower you to adapt effectively. By committing to enhance your knowledge and skills, you can strengthen your financial foundations and create a prosperous future that reflects your aspirations.

Napoleon Hill taught that wealth begins with a clear goal. Next, we will explore the concept of definiteness of purpose and how it shapes your path to success.

The Concept of Definiteness of Purpose

The Concept of Definiteness of Purpose

Setting clear financial goals is vital for achieving financial freedom. By aligning your actions with these objectives, you establish a roadmap that guides your journey. To maintain motivation and combat procrastination, developing consistent habits is essential. Overcoming obstacles will help you stay focused on your vision, elevating your consciousness and driving you toward wealth-building success.

Setting Clear Financial Goals

Setting clear financial goals is a foundational step in achieving wealth-building success. By defining what you want to accomplish financially, you create a concrete framework that helps direct your efforts. This clarity enables you to apply faith in your abilities and the wisdom gleaned from experiences, equipping you to navigate challenges effectively.

Utilizing the principles of Thinking Into Results (TIR for Individuals) can enhance your goal-setting process. This approach encourages you to visualize your outcomes and affirm your commitment to them daily. By reinforcing these goals with positive thought patterns, you prime your subconscious to recognize and seize opportunities that align with your financial aspirations.

To stay on course, it’s essential to track your progress regularly and adjust your strategies as needed. Developing a plan that includes actionable steps creates accountability and reinforces your commitment to your financial objectives. By embracing this structured approach, you will foster an environment conducive to achieving your wealth-building goals:

- Define specific financial objectives.

- Utilize TIR for Individuals to visualize success.

- Monitor progress and adjust strategies accordingly.

Aligning Actions With Objectives

Aligning your actions with your financial objectives is crucial for achieving the wealth you desire. This alignment ensures that every step you take moves you closer to your goals, creating a clear path to success. You may find that by prioritizing tasks that directly support your aspirations, you enhance your productivity and maintain focus on your mission.

To effectively align your actions, consider developing a strategic action plan that outlines specific tasks and milestones. This plan acts as a roadmap, guiding your decisions and daily activities toward your financial objectives. By regularly reviewing and updating this plan, you can adjust your strategies as necessary for optimal results.

Accountability plays a key role in this process. Engaging a mentor or accountability partner can significantly enhance your ability to stay aligned with your goals. Sharing your objectives and progress with someone you trust encourages you to take consistent action and fosters a supportive environment that fuels your ambition:

Overcoming Obstacles to Stay Focused

Overcoming obstacles is crucial in maintaining focus on your financial goals. You may encounter distractions, self-doubt, or external challenges that disrupt your progress. It’s important to acknowledge these barriers and develop strategies to navigate them effectively, ensuring you remain committed to your vision.

One practical approach is to establish a daily routine that prioritizes your financial objectives. By dedicating specific time slots for focused work on your goals, you create an environment conducive to productivity. Moreover, minimizing distractions during these periods helps you concentrate on what truly matters for your wealth-building endeavors.

Engaging with a mentor or accountability partner can significantly aid your efforts. Having someone to share your goals with not only encourages consistency but also provides you with valuable insights into overcoming hurdles. This support system keeps you motivated and reinforces your commitment to achieving financial success:

With a clear purpose guiding your actions, the next step unfolds: the power of a mastermind alliance. It’s not just about individual goals anymore; it’s about forging connections that propel your investments to new heights.

The Mastermind Alliance and Its Role in Investing

The Mastermind Alliance and Its Role in Investing

Building a network of like-minded individuals is crucial for your success in the investment world. By leveraging collective knowledge, you can enhance your decision-making process and uncover unique opportunities. Explore case studies of successful mastermind collaborations to see how shared insights and support have led to significant financial gains, emphasizing the power of collaboration in wealth building.

Building a Network of Like-Minded Individuals

Building a network of like-minded individuals is essential for enhancing your investment journey. Surrounding yourself with a group of motivated and knowledgeable peers can provide you with diverse perspectives and ideas that fuel your financial growth. When you engage with others who share your goals, you create an environment rich in collaboration and innovation.

Incorporating the principle of the Mastermind Alliance from Napoleon Hill, you can harness collective intelligence to make informed investment decisions. By creating this alliance, you facilitate open discussions that lead to insightful strategies and potential opportunities. This network serves as a support system, encouraging you to take risks and pursue ventures you may have previously overlooked.

To maximize the benefits of your network, actively seek out individuals who complement your skills and knowledge base. Consider establishing regular meetings or discussion groups to share insights, challenges, and successes. By maintaining consistency in these interactions, you not only cultivate relationships but also build a valuable resource for navigating the complexities of investing:

- Collaborate with individuals who share your financial goals.

- Engage in open discussions to explore new investment opportunities.

- Establish regular meetings to foster accountability and growth.

Leveraging Collective Knowledge for Investment Decisions

Leveraging collective knowledge is a fundamental strategy for making informed investment decisions. Engaging with a Mastermind Alliance allows you to tap into the diverse experiences and insights of others, enhancing your understanding of market trends and investment opportunities. When you collaborate with peers, you gain access to information that you might not have considered on your own, which can lead to more strategic decisions and increased financial growth.

Collaborating within a network also promotes accountability, pushing you to refine your investment strategies. When you share your goals and challenges with others, you create an environment where participants feel responsible for each other’s progress. This shared commitment can help you overcome emotional barriers to investing and encourage you to take calculated risks that align with your financial objectives.

Moreover, the discussions within your network can reveal innovative approaches to common investment challenges. By brainstorming solutions with others who have faced similar obstacles, you can develop new strategies that drive your investment success. As you leverage the collective intelligence of your alliance, you empower yourself to adapt to changing market conditions and seize opportunities as they arise, ultimately fostering greater wealth accumulation.

Case Studies of Successful Mastermind Collaborations

Successful mastermind collaborations can significantly enhance your investment strategies through shared insights and diverse perspectives. One notable example involves a group of real estate investors who formed a mastermind alliance to leverage each other’s expertise. By regularly meeting to discuss market trends and investment opportunities, they collectively identified lucrative properties, resulting in increased profits for each member. This collaboration illustrates the power of pooling knowledge and experience to achieve greater financial outcomes.

In the tech industry, a group of startup founders established a mastermind alliance to tackle common challenges they faced in scaling their businesses. Through open discussions, they exchanged ideas about securing funding, improving customer engagement, and optimizing operations. This collaboration not only led to individual business growth but also fostered relationships that resulted in successful partnerships and joint ventures. Such case studies showcase how collaboration can propel your business forward and enhance your investment acumen.

Another instance of effective mastermind collaboration can be found in a group of financial advisors who meet regularly to discuss investment strategies and market analysis. By sharing their experiences and insights, they develop comprehensive approaches that benefit their clients. The collaboration leads to improved decision-making and innovative solutions to complex financial questions. This example reinforces the importance of building a strong network through mastermind alliances to boost your investment capabilities and navigate challenges effectively.

As you strengthen your alliance with like-minded investors, you realize the real power lies in belief. The next step is to harness faith and visualization, for they are the true keys to unlocking wealth.

Faith and Visualization in Achieving Wealth

Developing a wealth mindset is essential for achieving financial success. By exploring techniques for effective visualization, you can align your thoughts with your financial goals. This alignment turns your beliefs into action, paving the way for tangible results. In this section, you will learn practical methods to cultivate a wealth-focused mindset that supports your investment journey.

Developing a Wealth Mindset

To develop a wealth mindset, start by recognizing that your thoughts directly influence your financial outcomes. By maintaining a positive outlook and focusing on opportunities rather than obstacles, you create an environment that fosters financial success. This shift in perspective allows you to better identify and pursue the investments that will yield significant returns.

Visualization is a powerful tool in this process. You should take time each day to envision your financial goals as achieved realities. Picture yourself living the life you desire, whether it’s financial freedom, a thriving business, or new investment opportunities, and let this mental imagery reinforce your belief in your ability to reach those goals.

Additionally, incorporating daily affirmations that reflect your financial aspirations can solidify your commitment to a wealth mindset. As you consistently remind yourself of your potential and the goals you are working toward, you align your subconscious with your conscious efforts. This alignment energizes your actions and decisions, directing them toward achieving the wealth you seek.

Techniques for Effective Visualization

To effectively engage in visualization, begin by creating a quiet space where you can focus entirely on your financial goals. Close your eyes and picture yourself achieving specific milestones, such as reaching a desired savings target or successfully launching a business. This mental exercise not only clarifies your aspirations but also embeds them deeply in your subconscious, allowing you to act with intention toward your financial success.

Incorporating sensory details into your visualization practice can enhance its effectiveness. For instance, imagine the emotions you would feel upon achieving wealth, such as excitement and fulfillment. By vividly experiencing these sensations in your mind, you strengthen your belief in your ability to manifest your financial objectives, aligning your mindset with the reality you wish to create.

Another powerful technique is to utilize vision boards, which visually represent your financial goals. You can include images and quotes that resonate with your aspirations, enabling you to see your goals regularly. Displaying this board in a prominent place serves as a constant reminder of your ambitions, reinforcing the faith needed to stay committed to your wealth-building journey.

Turning Beliefs Into Financial Success

Your beliefs play a crucial role in shaping your financial reality. When you genuinely believe in your potential for success, you activate a mindset that attracts opportunities and resilience. This belief system acts as a catalyst, motivating you to take decisive actions that align with your financial aspirations. By trusting in your abilities, you create an empowering environment that supports your journey toward wealth building.

Believing in your vision is vital, but it’s only part of the journey. To truly thrive, you must arm yourself with specialized knowledge that sharpens your path to success.

The Importance of Specialized Knowledge

The importance of specialized knowledge in wealth building cannot be overstated. Continuous learning in investment strategies equips you with the tools to navigate complex markets effectively. By utilizing expertise to make informed decisions, you enhance your investment outcomes significantly. Additionally, exploring various resources for expanding investment knowledge allows you to stay ahead in this dynamic environment, ultimately driving your financial success.

Continuous Learning in Investment Strategies

Continuous learning in investment strategies is vital for your success in wealth-building endeavors. Investing in your knowledge allows you to stay updated on market trends, emerging opportunities, and economic shifts. By enrolling in courses, attending seminars, or reading industry publications, you position yourself to make informed decisions that enhance your investment outcomes.

As you develop your expertise in investment strategies, consider the importance of networking with industry professionals. Engaging with knowledgeable individuals can provide you with valuable insights and different perspectives on investment opportunities. This active collaboration can broaden your understanding and encourage you to apply best practices that lead to financial success.

To reinforce the value of continuous learning, establish a routine that incorporates regular review of your investment strategies. Set aside time each week to analyze your portfolio and research new investment options. This consistent approach not only keeps your skills sharp but also encourages proactive adjustments based on your findings:

Utilizing Expertise to Make Informed Decisions

Utilizing expertise in your investment decisions is essential for effective wealth building. Engaging with professionals who possess specialized knowledge can provide you with insights and strategies that are aligned with current market trends. By consulting with experts, you can enhance your understanding of investment opportunities and make informed choices that drive your financial growth.

When you actively seek out expert opinions, you place yourself in a strong position to decipher the complexities of various investment avenues. For instance, a financial advisor can guide you in developing a robust investment portfolio, ensuring that your decisions are based on thorough analysis and tailored to your specific financial goals. This personalized approach helps you navigate potential risks and capitalize on opportunities more successfully.

Moreover, leveraging the expertise of industry specialists allows you to learn from their experiences and successes, saving you time and resources in your investment journey. Surrounding yourself with knowledgeable individuals can lead to collaborative opportunities, broadening your perspective and enhancing your decision-making process. Ultimately, embracing specialized knowledge empowers you to make confident, informed investments that contribute to your wealth-building objectives.

Resources for Expanding Investment Knowledge

To expand your investment knowledge effectively, start by utilizing online courses from reputable platforms like Coursera or Udemy. These resources provide structured learning from industry experts and cover various investment strategies that align with your financial goals. By engaging in these courses, you not only enhance your understanding but also gain actionable insights that can be directly applied in your investment decisions.

Reading investment books written by established authors is another important resource for developing specialized knowledge. Consider exploring titles such as “The Intelligent Investor” by Benjamin Graham or “Rich Dad Poor Dad” by Robert Kiyosaki. These books offer timeless principles and practical advice that can guide your approach to investing, enabling you to make informed choices and navigate the complexities of the financial market.

Networking with professionals in investment groups or attending financial seminars can greatly enhance your investment knowledge as well. Engaging in discussions with experienced investors helps you gain diverse perspectives and insights into market trends. These interactions can spark new ideas and encourage you to adopt effective strategies that support your financial aspirations, ultimately aiding you in achieving your wealth-building goals.

Specialized knowledge builds a strong foundation, but the real test comes when you face obstacles. It is persistence in the face of failure that solidifies your path to success.

Persistence and Overcoming Failures

Learning from financial setbacks is a crucial step in your wealth-building journey. By understanding your failures, you can identify valuable lessons that sharpen your investment strategy. This section will also explore practical strategies to maintain motivation through challenges and share real-life examples where persistence has led to significant wealth creation. Each topic reinforces the idea that resilience is key to your financial success.

Learning From Financial Setbacks

Learning from financial setbacks is integral to your growth as an investor. When you experience a loss or a setback, it is an opportunity to reflect on your strategies and decisions. Analyzing what went wrong allows you to identify weaknesses in your approach, enabling you to refine your investment skills for future success.

To effectively recover from setbacks, maintain a mindset that embraces learning rather than discouragement. Understand that many successful investors have faced failures before achieving their goals. By viewing each setback as a stepping stone on your path to financial growth, you can build resilience that strengthens your determination to pursue your objectives.

Practical strategies, such as documenting your experiences and seeking feedback from trusted advisors, can enhance your learning process. Engaging in open discussions about failures will provide valuable insights while reinforcing your commitment to improvement. By transforming setbacks into actionable lessons, you pave the way for a more successful and informed investment journey.

Strategies to Maintain Motivation

To maintain motivation on your wealth-building journey, it’s essential to develop a structured routine that reinforces your commitment. You can set aside dedicated time each day for activities related to your financial goals. This consistency fosters a sense of accountability and keeps you engaged in your investments and educational pursuits, ultimately driving you closer to success.

Another effective strategy is to regularly remind yourself of your long-term objectives. Creating visual reminders of your goals can serve as powerful motivators. You could utilize vision boards that reflect your aspirations, helping you to stay focused on the bigger picture even when faced with setbacks. When you consistently see these reminders, you reinforce your determination to overcome challenges.

Additionally, connecting with a mentor or joining a supportive group can significantly aid in maintaining your motivation. Engaging with individuals who share similar goals fosters a sense of community and provides encouragement during tough times. By sharing experiences and insights, you can inspire each other to persist, ensuring that your ambitions remain strong even in the face of adversity:

Real-Life Examples of Persistence Leading to Wealth

Consider the story of a small business owner who faced numerous challenges during his first year. Initial setbacks, such as supply chain disruptions and a lack of customer awareness, tested his resolve. Instead of giving up, he implemented feedback from his customers, adjusted his marketing strategies, and remained committed to his vision, ultimately leading to increased sales and a loyal customer base.

Another compelling example comes from a well-known entrepreneur who encountered multiple failures before achieving success. After three failed startups and significant financial losses, he refused to let those experiences define his journey. He leveraged the lessons learned from each failure to refine his business model, successfully launching a company that became a frontrunner in its industry, demonstrating the power of persistence and learning from failures.

Lastly, think of an investor who faced substantial losses in a volatile market. Instead of retreating, he indexed his approach and sought knowledge from industry experts on effective hedging strategies. His willingness to adapt and persist through adversity allowed him to make informed decisions, eventually recovering his investment losses and building a diversified portfolio that generated substantial wealth over time.